AROUND GDP AND THE ROAD AHEAD

The GDP numbers show a slowdown in the country’s economic activity. The Indian economy grew 4.4% in Q3FY23 compared to 6.3% in the previous quarter. The numbers are weaker than the previous year due to the change in base. The slowing growth is a reflection of geopolitical tensions, global slowdown, and tightening of global financial conditions.

According to a study released by SBI, corporate margins are under pressure. The results of around 3000 listed entities ex-BFSI show a decrease in EBITDA margins due to higher input costs. This has affected the bottom line, even though the top line grew by 15% in Q3FY23.

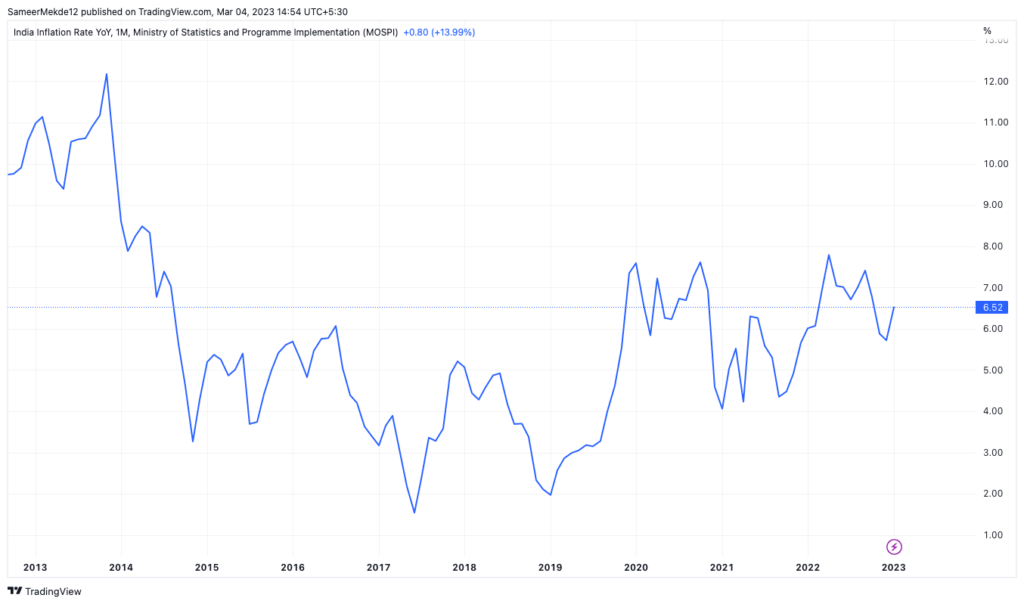

The full-year GDP growth is estimated at 7% compared to the previous year’s growth of 9.1%. Slowing growth is attributed to weak external demand as central banks globally continue monetary tightening to tame inflation.

We are optimistic about the Indian economy and its placement on the global trade map. According to an IMF report, India and China alone are expected to contribute more than half of global growth this year.

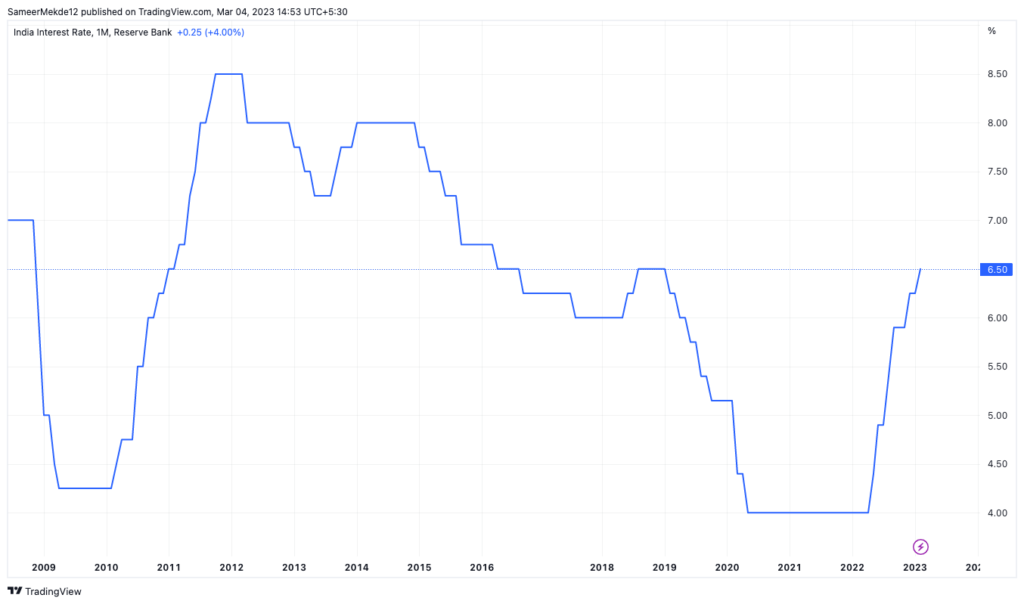

With expectations that inflation must be peaking now, we see the interest rate cycle bottoming out this year. With RBI slowing the rate hike to 25bps in the upcoming policy meeting, we could see a turnaround in economic activity.

About the Markets

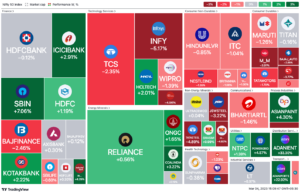

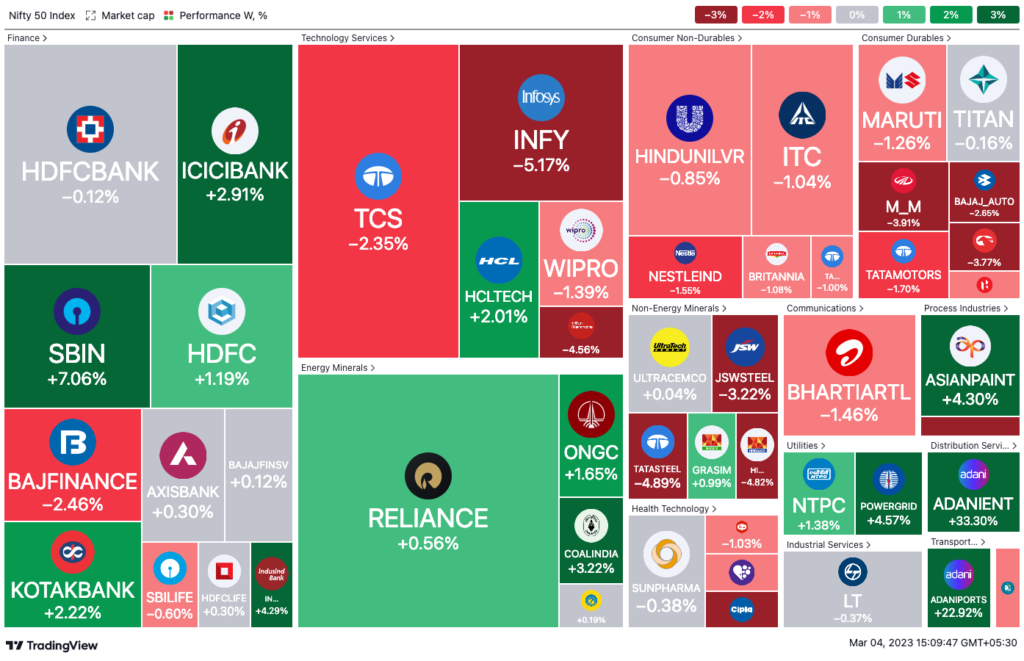

Last week, the losing streak that started on Feb 16th was finally paused, and we saw some positive movement for the Nifty 50. The closing for the week was near the 200 EMA level, which is a very important level to watch for. The index opened at 17428 and ended almost 1% higher at 17594. Adani Group stocks saw the most growth, with Adani Enterprises surging by 33% and Adani Ports by 22.92%. Cipla ended the week 8.58% lower, possibly due to observations made by the US FDA, though the further context is needed to confirm this.

Rupee closed at 81.66 against US$ showing strength in February 2023

We saw an m-o-m downward trend in India’s Forex Reserves. We stand at ~ $561Bn

Automobile Industry Numbers

The automobile industry posted robust numbers last month, with domestic passenger vehicle sales reaching 3.35 lakhs in February 2023, showing a growth of 10.6% over the same month last year. Two-wheeler companies showed 15%-28% year-on-year growth in sales volume. Commercial vehicles and three-wheelers reported double-digit year-on-year growth. Improving consumer sentiments, good demand, and availability of finance supported tractor sales to clock double-digit growth during February 2023.