INDIA CONTINUES TO BE ON THE PATH TO BE A $ 3 TRILLION ECONOMY

the aim laid by our Prime Minister Mr. Narendra Modi. But we are mildly succumbing to Geo political tensions

Tax Collections

GST collections have stayed over 1.4 Lakh Crores since March 2022. This will make things better for the Government to control the fiscal deficit which is otherwise affected by higher commodity prices and a stronger dollar. The tax budget remains robust, better than the budgeted estimates. Experts expect it to be over 3 Lakh crores above the estimates.

Inflation

Inflation moderated in October 2022 but continues to be a cause of concern for RBI. Whether it’s a temporary slowing in inflation before another jump. Well, time will let us know. But the Global Inflation problem is likely to have a spillover. Inflation in the UK hit a record of 13.3% once again raising the fear of a difficult year ahead.

Banking

The Net NPA numbers are at a multi-year low at 1.3% of the total asset size. The deposit growth though slow is picking up. With these factors in place, banks would continue to shine the show.

Domestic Consumption

India’s growth is majorly contributed by private consumption which we think might increase with the easing of inflation in turn adding to growth. Domestic air traffic hits record high with a number of passengers crossing 4 Lakh passengers. Consumer Loans and personal loans are growing, which shows confidence in India’s Growth story (Passenger vehicle growth in the month of November 22 was seen at 26% yo- y)

Trade

India’s CAD remain a bigger concern. This is primarily due to weak rupee. Higher imports of Gold, travel, Coal and electronics need to be curtailed further to reduce the imports. Exports will continue to be slow owing to slowdown in Global Economies. Trade deficit with China alone is likely to exceed USD 87 billion. India’s global export share is at 1.8% whereas the GDP share is roughly about 3.4%. Despite these prevailing problems, India’s Mobile phone exports improved from -7.7$ billion in 2015 to 3.3$ and toys exports improved from -292$ million in 17-18 to 153$ million in 21-22. Though CAD remains a going concern but we assume the situation is likely to improve further.

India’s G20 presidency is the cherry on the cake. This is likely to attract global attention, tourism and investments

Our Verdict

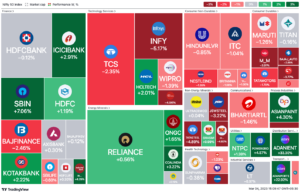

Despite slow or no growth globally owing to Geo Political concerns, India is likely to stand out. From the Valuations front, we are slightly more expensive as compared to other emerging markets including Vietnam, Brazil, and China. We might see some value in unwinding. We may see markets consolidating till earnings are visible.